Do you remember when going to school meant being part of a community? When parents and teachers worked together to ensure that students were safe, well-educated, and emotionally healthy?

Do you remember when strong relationships were established, and God remained central to everything? At Westminster, you’ll find exactly what you’ve been missing–a thriving Christian school and a community for your family.

Kerry St. John

Director of Christian Life

Welcome Home

We understand that choosing the right school for your family is one of the most important decisions you’ll make. At Westminster Christian Academy, we put equal focus on academic excellence and Christian discipleship so that each student is prepared to answer God’s call in their life.

What can you expect at WCA?

Our Philosophy

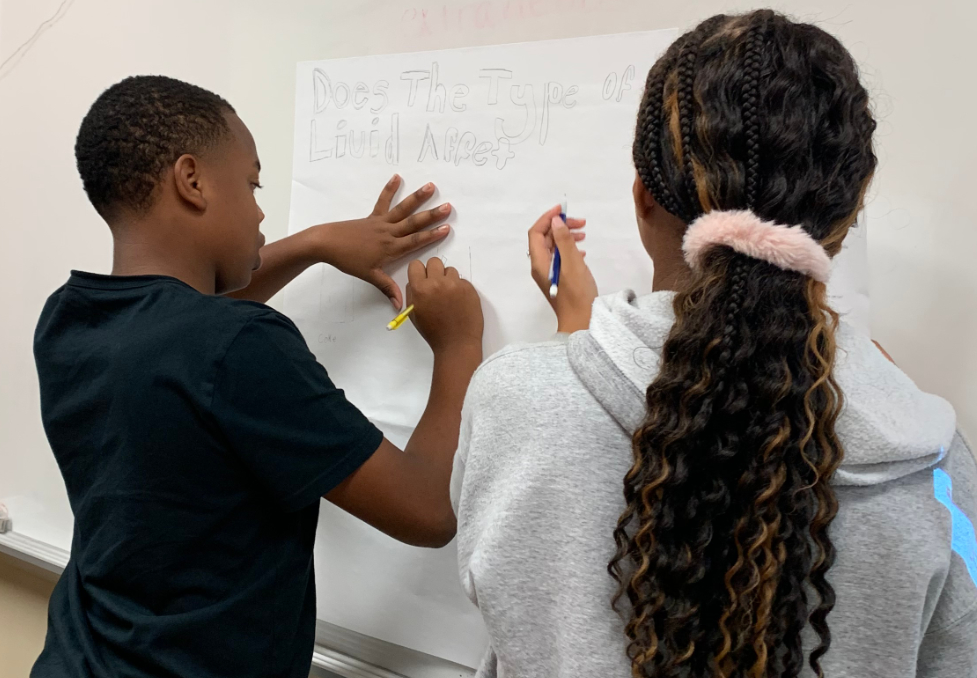

At Westminster Christian Academy, our goal is to help students reach their full potential through spiritual growth and academic excellence. Our students receive an exceptional Christ-centered education, nurturing a Christian worldview as the foundation for academic and personal life.

A Foundation of Faith

Our vision is to educate and disciple students, in partnership with Christian families, for lifelong learning and service in God’s world. As a covenantal Christian school, we require that at least one parent from every family be a professing follower of Jesus Christ, have a church home and pastoral relationship, and support the beliefs found in the Nicene Creed.

Excellence in Education

Westminster Christian Academy is the only school in Alabama with CESA accreditation, which shows our commitment to exceptional academic and institutional standards. Westminster is also Cognia accredited and is ranked #1 Best Christian High School in the Hunstville Area on Niche.com.

We offer a wide range of academic options from basic college preparatory to AP and Dual Enrollment classes, encouraging students to become critical thinkers and lifelong learners. We continually evaluate our high school academic program to discern the need for new classes to challenge our students.

If you're looking for a community where your child can grow, we hope you’ll consider Westminster Christian Academy. We’re ready to partner with you so that your child will become a lifelong learner who is prepared for service in God’s world.